The new NSFAS card that forms part of the new banking system Photo NSFAS

South Africa – The National Student Financial Aid Scheme (NSFAS) has made significant changes to its banking system. The new system, called #NSFASBankAccount, outsources the provision of allowances to external companies, a departure from the previous practice of distributing funds directly to universities for allocation to NSFAS students. While the system was supposed to be an improvement on the last, it has raised concerns and created several challenges for the affected students.

The system was introduced in 2022 for students in TVET colleges and now it has been introduced to university students. On its website NSFAS states the new system of taking over direct payments “is to ensure its accountability on student allowances and to establish a better coordinated system of the transfer of funds to students”. While NSFAS expected the new system to be “not only convenient to students but also to provide for allowances in a manner that is both dependable and predictable to students”, political activist and Wits university student, Bahle Sibanda, said it has been anything but that.

Financial implications for students using eZaga

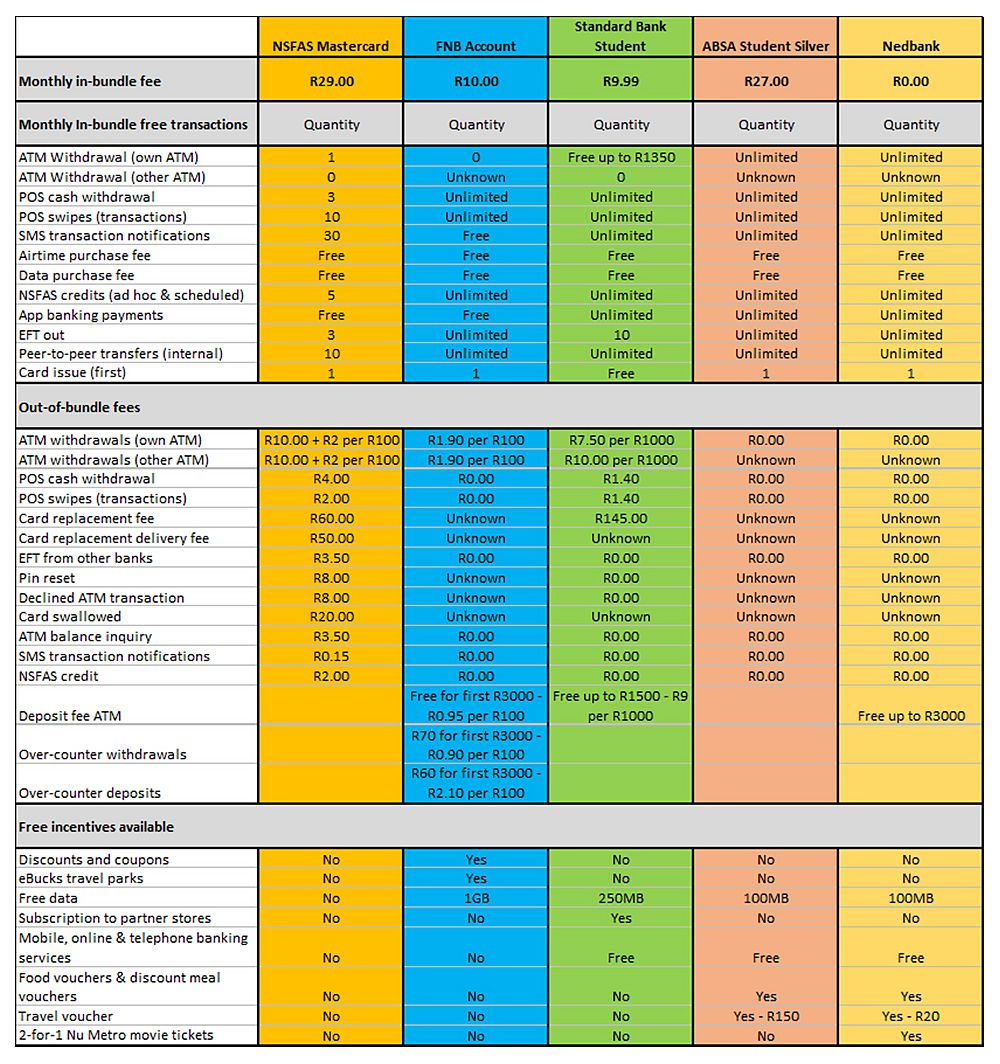

The new banking companies contracted by NSFAS charge higher fees for student accounts compared to traditional banks. These additional financial burdens have left many students in a state of confusion and misery.

“What these new ‘banking companies’ are doing; is they’re charging more for student accounts than the normal banks. For example, R29 for the monthly bundles versus the R10 for what normal banks will charge. R12 for a R100 ATM withdrawal versus R7,50 per R1000 for a normal bank. Many students have been left in misery and confusion. Some have even been defunded. No allowances have been given out and honestly at this point NSFAS doesn’t even have an answer for students.”

What is interesting to find is the companies that won the tender, eZaga, Coinvest, Narroco and Tenetech managed to beat established South African companies Standard Bank, Absa and FNB. More surprising is, according to the Organisation Undoing Tax Abuse (OUTA), these companies did not have banking licences or VAT registrations, which was supposed to be a compulsory bid requirement, to make direct payment of student allowances at the time of competing for the bid. Only eZaga Holdings held an affiliated banking licence with Access Bank.

In fact, these four companies are relatively new. Coinvest Africa was registered in 2019, Tenet Technology was registered in 2013 but remained dormant until 2021, Norraco Corporation was registered in 2019 and eZaga Holdings was registered in 2017. The tender runs for five years and OUTA estimated it could be worth at least R1.5 billion

SMread: South African Pilgrims Share Unforgettable Experiences of Hajj

The call for action by political activists and student representatives

Given the adverse effects of the new banking system, political activists, student representatives, and the Socialist Youth Movement have taken a stand against it. Student Representative Councils (SRCs), such as the EFF Student Command, have threatened to take to the streets in protest, emphasising the unacceptability of the situation.

“We are calling for a removal of the system that NSFAS first enacted and also a review of the system that incorporates the students. The SRCs, they’ve put out statements and some of them, I believe it’s the EFF Student Command and multiple universities have threatened to take to the streets because this is unacceptable. If they do so, we will most likely be joining them.”

While discussions are ongoing, there has been a lack of concrete communication from NSFAS, and the banking companies involved. Students visiting NSFAS offices have been informed that they are awaiting communication from the banking companies, who, in turn, have not provided any feedback or response timeframe, said Sibanda. This lack of clarity has left students feeling helpless and uncertain about their future funding.

The recent changes to the Naspers banking system have had a profound impact on NSFAS-funded students in South Africa. The increased fees and lack of effective communication have left many students facing financial hardships and uncertainty about their future. The possibility of protest action looms if a resolution is not reached within the specified timeline.

Bahle Sibanda discussed with Julie Alli the possibility of a student protest happening as well as how the lives of students have been impacted. Listen to that discussion here: